The giant Arun Field is nearing the end of its life as an oil and gas producer but the Government of Aceh has a vision which sees the field continuing as an economic powerhouse for years to come. In November 2022 a new company called PT PEMA Aceh Carbon was established to repurpose the Arun Field for the storage of carbon dioxide.

From 1980 to 2000 Indonesia was the world’s largest exporter of Liquefied Natural Gas (“LNG”) and the giant Arun Field in Aceh, discovered by Mobil Oil Corporation in 1971 was responsible for around 30% of Indonesia’s LNG production. During the early 1990s the Arun Field was producing more than 100,000 barrels of condensate per day and 3,500 million cubic feet of gas per day which was feeding 6 LNG trains capable of producing more than 10 million tons of LNG per annum. The field was responsible for 25% of Mobil’s global profits and was one of the cornerstones of the Indonesian economy.

Figure One – The Government of Aceh has established a new company

called PT Pema Carbon Aceh to repurpose the Arun Field for the storage

of carbon dioxide.

Figure One – The Government of Aceh has established a new company

called PT Pema Carbon Aceh to repurpose the Arun Field for the storage

of carbon dioxide.

Although the field continues to produce very small volumes of gas, the Arun LNG business was shut down in 2014 due to declining production rates and low reservoir pressures. Arun is one of the largest oil and gas fields in the Asia Pacific with cumulative production of more than 16 trillion cubic feet of gas and 700 million barrels of condensate. It is now one of the largest, if not the largest, depleted oil and gas fields in the region.

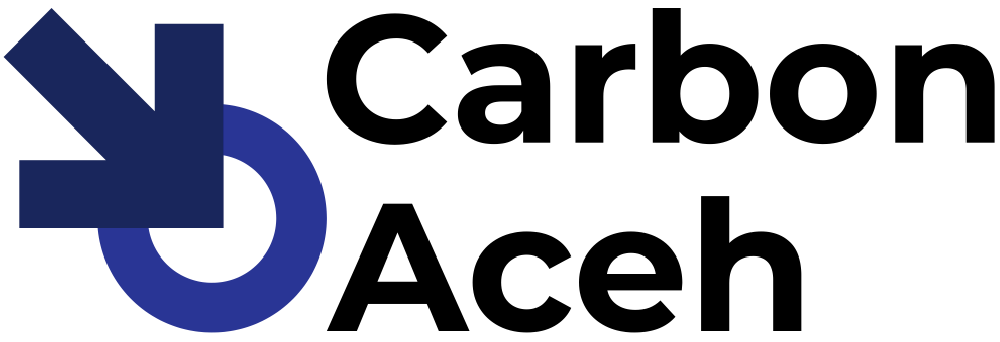

In November 2022 the Government of Aceh, through its wholly owned company PT Pembangunan Aceh (PEMA), formed a Joint Venture company called PT PEMA Aceh Carbon (PT PAC) to repurpose the Arun reservoir for the storage of carbon dioxide (CO2). The Arun Carbon Capture and Storage project (“Arun CCS”) will provide jobs and economic growth in Aceh while also making a significant contribution towards the emission reduction targets adopted by the Government of Indonesia under the Paris Agreement.

The role of Carbon Capture and Storage (CCS) in meeting global energy and climate goals is now widely acknowledged. Without CCS the world will not even come close to meeting emissions reduction targets. The International Energy Agency (IEA) and the Intergovernmental Panel on Climate Change (IPCC) predict that CCS will make a significant contribution (15-55%) of the abatement required to hold atmospheric concentrations of greenhouse gases to 450 parts per million (ppm) by 2050. The size of the global CCS industry could approach that of the world natural gas industry within a few decades creating a significant engine of growth, alongside renewable energy, in the new low emissions economy.

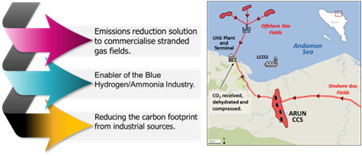

-----The Arun Field is an Early to Middle Miocene carbonate build-up located above a structural high associated with Paleocene-Oligocene rifting (Figure Two). Several significant sea-level fluctuations in the late stages of build-up development resulted in secondary permeability within the upper parts of the feature which significantly enhanced reservoir quality. The reservoir is encapsulated and sealed by shale.

Figure Two – Arun Field cross-section and map

Figure Two – Arun Field cross-section and map

The Arun field was developed with wells and infrastructure concentrated into four clusters. More than 140 wells have been drilled across the field with most being equipped with 10,000 psi working pressure stainless-steel well heads to resist corrosion from high-pressure and high-temperature production fluids containing CO2.

Gas was reinjected into the reservoir through 12 injection wells for pressure maintenance. Over the period 1976 to 1997 5.2 trillion cubic feet of gas was reinjected into the reservoir providing valuable data on the behaviour of the reservoir during injection.

The field had a very high initial reservoir pressure of more than 7,000 psi and a temperature of 180°C at a depth of 3,000m sub sea. By 2005 reservoir pressure had decreased to around 500 psi which is encouraging from a CO2 injection perspective. A study by researchers from the University of Singapore published in 2022 estimated the storage potential of the Arun reservoir to be around 1.2 billion tonnes of CO2. This is similar to preliminary studies undertaken by PT PAC and would certainly make Arun CCS one of the largest projects in the world in terms of overall storage capacity. A critical factor in determining the economic viability of the project will be the rate at which CO2 can be stored, and the infrastructure and wells that will be required to implement the project. The Government of Aceh through PT PAC are undertaking a detailed feasibility study to determine the overall storage capacity of the reservoir, the anticipated rate that CO2 can be injected and to establish how much of the existing infrastructure can be repurposed for CCS which will include a major well integrity study.

Preliminary estimates in the 2022 study suggested a storage rate of 1.5 mtpa however preliminary studies by PT PAC suggest it might be significantly higher in the range 10-20 mtpa. To put this in context, the Gorgon CCS project operated by Chevron in Western Australia has stored 2.3 mtpa since inception and is estimated to have the capacity to store more than 100 million tons of CO2 over the life of the project. The Bayu-Undan Field in Timor-Leste, which had reserves less than one quarter of the Arun Field, is being promoted by Santos as one of the biggest CCS projects in the world with the capacity to store 10mtpa.

Until PT PAC completes its feasibility study of the Arun reservoir it is not possible to be definitive on the scale of the CO2 storage capacity, either in terms of annual rate or overall capacity, but what seems clear is that if successful, it has the potential to be one of the biggest projects in the Asia Pacific.

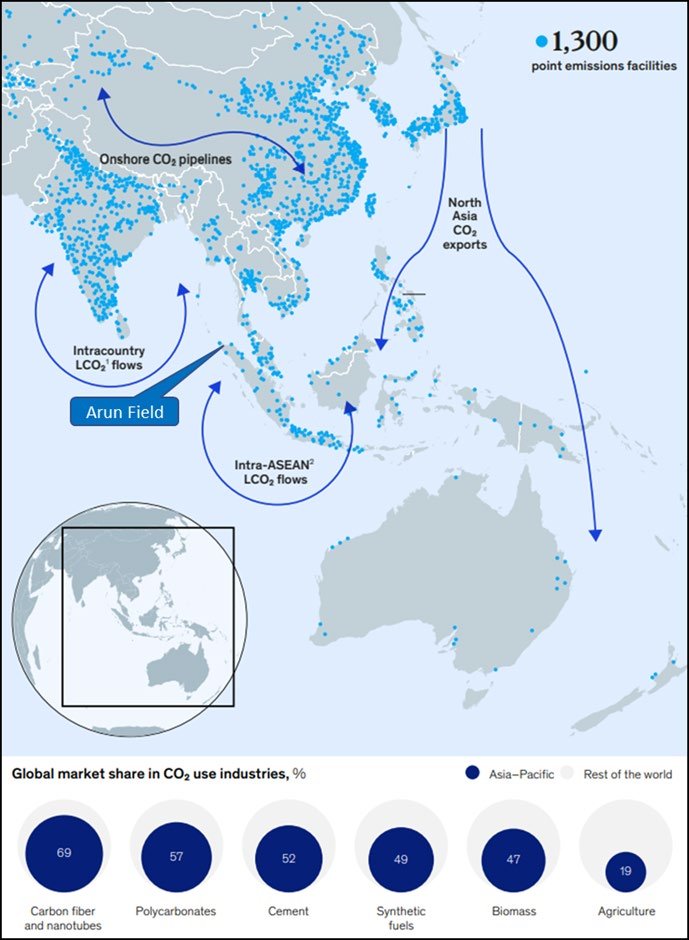

The Asia Pacific is currently lagging North America and Europe in the implementation of CCS projects however the landscape is changing rapidly. A recent study by McKinsey and Company (3) estimated that the Asia Pacific could account for 55% of global CCS capacity by 2050. The reasons for the emerging dominance of Asia Pacific appear well grounded in fundamentals. There are 1,300 major CO2 point emissions facilities across the Asia Pacific region which has a dominant global market share of primary CO2 use industries (Figure Two). The Arun Field is centrally located adjacent to point source emissions as well as being adjacent to several undeveloped gas fields with high CO2 content.

Figure Three – Asia Pacific global market share in CO2 use industries

and locations of primary point source CO2 emissions from McKinsey &

Company, 2023, Unlocking Asia Pacific’s vast carbon capture potential.

Figure Three – Asia Pacific global market share in CO2 use industries

and locations of primary point source CO2 emissions from McKinsey &

Company, 2023, Unlocking Asia Pacific’s vast carbon capture potential.

It is proposed to operate the Arun CCS project as an open-access hub which in effect means that the facility will be able to accept CO2 from multiple sources. The economic benefits of clusters of point source emissions sharing centralised CCS hubs are well established. The introduction of cost-effective CO2 shipping tankers means many of the geographic and logistical restrictions arising from trying to match CCS locations to emissions locations via pipelines are no longer applicable.

The Arun Field is strategically located with access to a deepwater port designed to accommodate LNG carriers. There is a pipeline route from the port to the field meaning the facility will be well placed to receive marine cargoes of CO2. This opens Arun to CO2 sources throughout Indonesia either from industrial operations or from undeveloped gas fields with high CO2 content.

One of the greatest challenges facing the countries of the Asia Pacific in establishing a viable CCS industry is the lack of international agreements to enable a cross border CO2 storage and transportation. Cross border transport of CO2 via pipeline to Indonesia is governed by existing regulations promulgated by Ministry of Energy and Mineral Resources however there are not yet any regulations permitting cross-border transportation of CO2 by ship. There are currently CCS projects involving cross-border transportation by ship being developed in Malaysia and Timor Leste and in Indonesia PERTAMINA and EXXON have announced an MoU for CCS projects that involve cross-border transportation. This presents an interesting proposition for the Government of Aceh to consider in the future as the project develops.

Repurposing Arun as a regional CCS hub will have a significant impact on the local and regional economy of Aceh. There will be new jobs created from both the construction and operation of the facility. There are undeveloped gas fields in the region potentially containing more than 500 million tonnes of CO2. These fields are currently stranded but could potentially be developed if CO2 were separated from the sales gas and stored in the Arun facility. The gas produced from these fields could be used to displace coal currently used in power generation and/or to produce blue hydrogen and ammonia. The latest generation of CO2 capable shipping tankers will have the ability to transport CO2 in one direction and ammonia on the return trip.

Arun CCS offers a compelling combination of economic growth with emissions reduction on a globally significant scale.

Carbon Aceh Pte Ltd is a Singaporean company specifically established to redevelop the Arun Field in Aceh, Indonesia as a Carbon Capture and Storage (CCS) facility. Carbon Aceh is a founding shareholder of PT PEMA Aceh Carbon.